About

Amazon.com, Inc is an American multinational technology company which focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence.

Company has organized its operations into three segments: North America, International, and Amazon Web Services (“AWS”).

Amazon.com serve consumers through our online physical stores and focus on selection, price, and convenience. Its stores are designed to enable hundreds of millions of unique products to be sold by Amazon and by third parties across dozens of product categories. Customers access its offerings through websites, mobile apps, Alexa, devices, streaming, and physically visiting our stores. Amazon also manufactures and sells electronic devices, including Kindle, Fire tablet, Fire TV, Echo, and Ring, and develops and produces media content. Also, Amazon offers subscription services such as Amazon Prime, a membership program that includes fast, free shipping on millions of items, access to award-winning movies and series, and other benefits.

Income Statement

In 1Q 2022 Amazon reported $116.4 billion in total revenue. It was growing 7.3% compared to first quarter in previous year.

The YoY growth has slowed down when looking at 2021, 2020 and 2019 Q1 revenue growth:

Operating income reported in the 1Q 2022 was $3.7 billion, which was 58.6% lower than in 1Q 2021.

Net income in 1Q 2022 was negative $-3.8 billion. The main reason for negative net income was $-8.57 billion in other expenses (mostly consisting of marketable equity securities valuation loss from equity investment in Rivian Automotive, Inc.)

Operating income margin in 1Q 2022 was 3.15%, which is lower than it was in first quarter in previous years. The trailing twelve-month operating margin was decreasing for four straight quarters.

In comparison, competitors’ YoY net income growth in 2021 were Net income margin in 1Q 2022 was -3.3%.

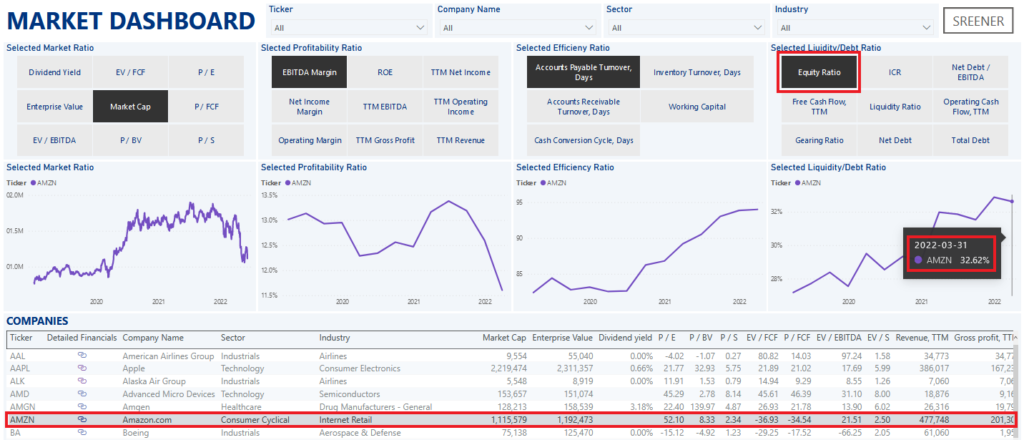

As of 2022-06-10 price-to-sales ratio of AMZN is 2.34.

Price-to-earnings ratio of Amazon as at 2022-06-10 was 52.1

At the end of 1Q 2022 Amazon’s return-on-equity was 16.87%

At the end of 1Q 2022 Amazon’s return-on-assets was 5.44%.

Balance Sheet

As at 2022-06-10 price-to-earnings ratio of Amazon was 8.33, as it can be seen from dynamic in time it has decreasing tendency.

At the end of 1Q 2022 Amazon had cash and cash equivalents of $36.4 billion, which is 8.86% of total assets.

Liquidity ratio is calculated by dividing current assets by current liabilities, in 1Q 2022 liquidity ratio decreased below 1 to 0.96, which means that current liabilities exceeded current assets.

The equity ratio (which is equal to shareholder’s equity divided by total assets) at the end of 2021 for Meta was 75.23%. It is the highest out of the mentioned competitors (Alphabet has a ratio of 70.04% and Twitter has a ratio of 51.98%) – the higher the ratio, the lower the company’s liabilities are as a percentage of company’s assets.

The equity ratio (which is equal to shareholder’s equity divided by total assets) at the end of 1Q 2022 of Amazon was 32.62%.

Cash Flow Statement

At the end of 1Q 2022 the trailing twelve-month total cash flow of AMZN was $2.44 billion.

Working capital is calculated by adding Inventories, Trade receivables, Prepayments paid and subtracting Trade payables and Prepayments received. At the end of 1Q 2022 it was $-1 billion and Amazon has an increasing working capital tendency since the beginning of 2021.

The cash conversion cycle (CCC) is a metric that expresses the time (measured in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales. The lower the CCC the better. Amazon’s CCC in 1Q 2022 was -30.43 days, but has increased in several previous quarters.

Amazon is not paying dividends at the moment.

Conclusion

+

- Revenues are increasing year-over-year

- Price-to-sales and price-to-book ratios are at lowest level in recent years

–

- Operating and net income margins have decreased

- Return on assets and return on equity decreased sharply in 1Q 2022